Overview

Our client is one of the largest banks in the United States. It employs over 259,000 people, serves one in three U.S. households, and has a market capitalization of over $222 billion.

After over 20 years of mergers and acquisitions, the bank realized their processes for completing many transactions - stopping a payment, getting a refund for an overdraft, and more - were not consistent across the organization or across channels, creating substantial issues for staff and customers.

After over 20 years of mergers and acquisitions, the bank realized their processes for completing many transactions - stopping a payment, getting a refund for an overdraft, and more - were not consistent across the organization or across channels, creating substantial issues for staff and customers.

Offerings

CX Strategy

Standardized processes for better employee and customer experiences

The Solution

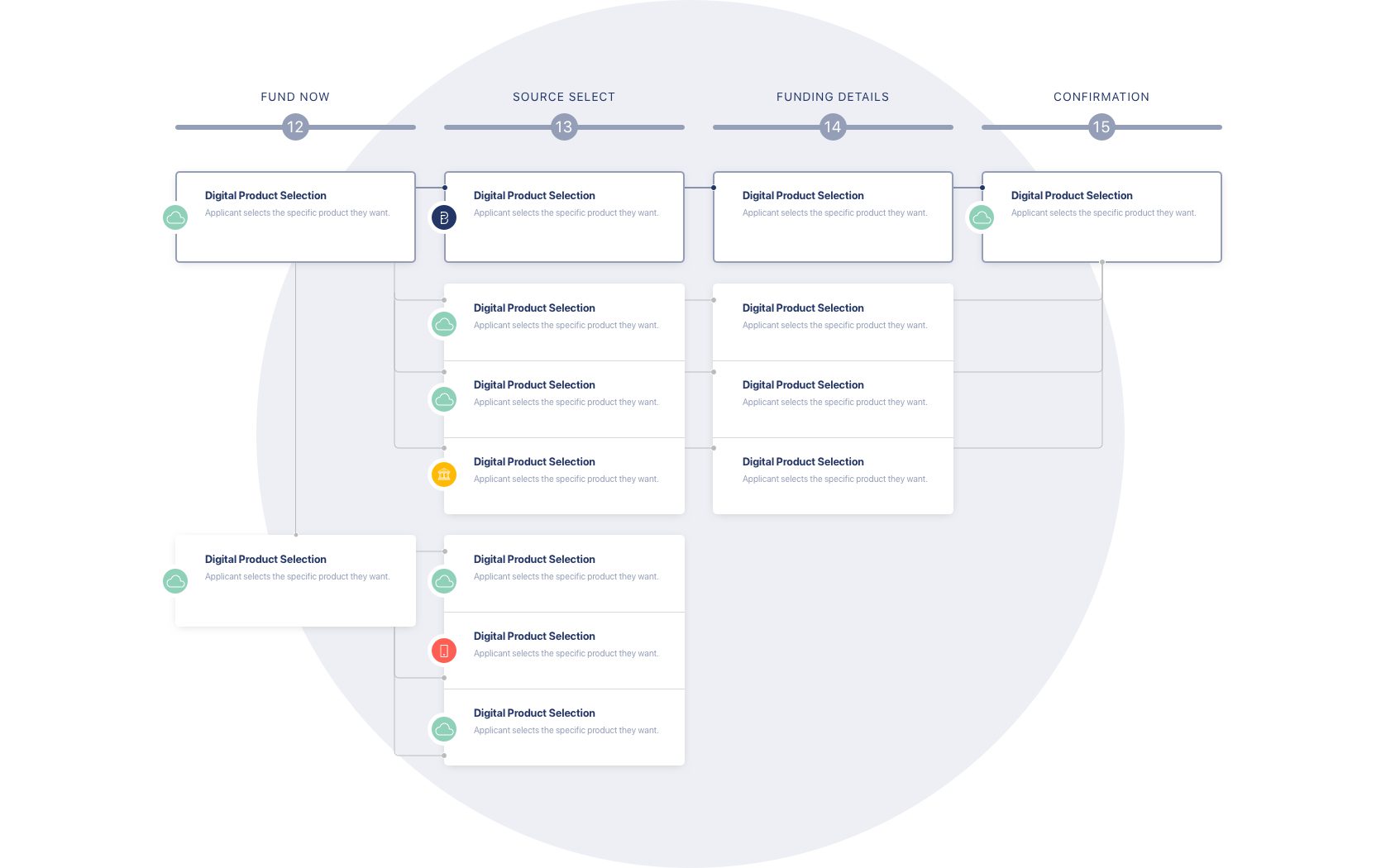

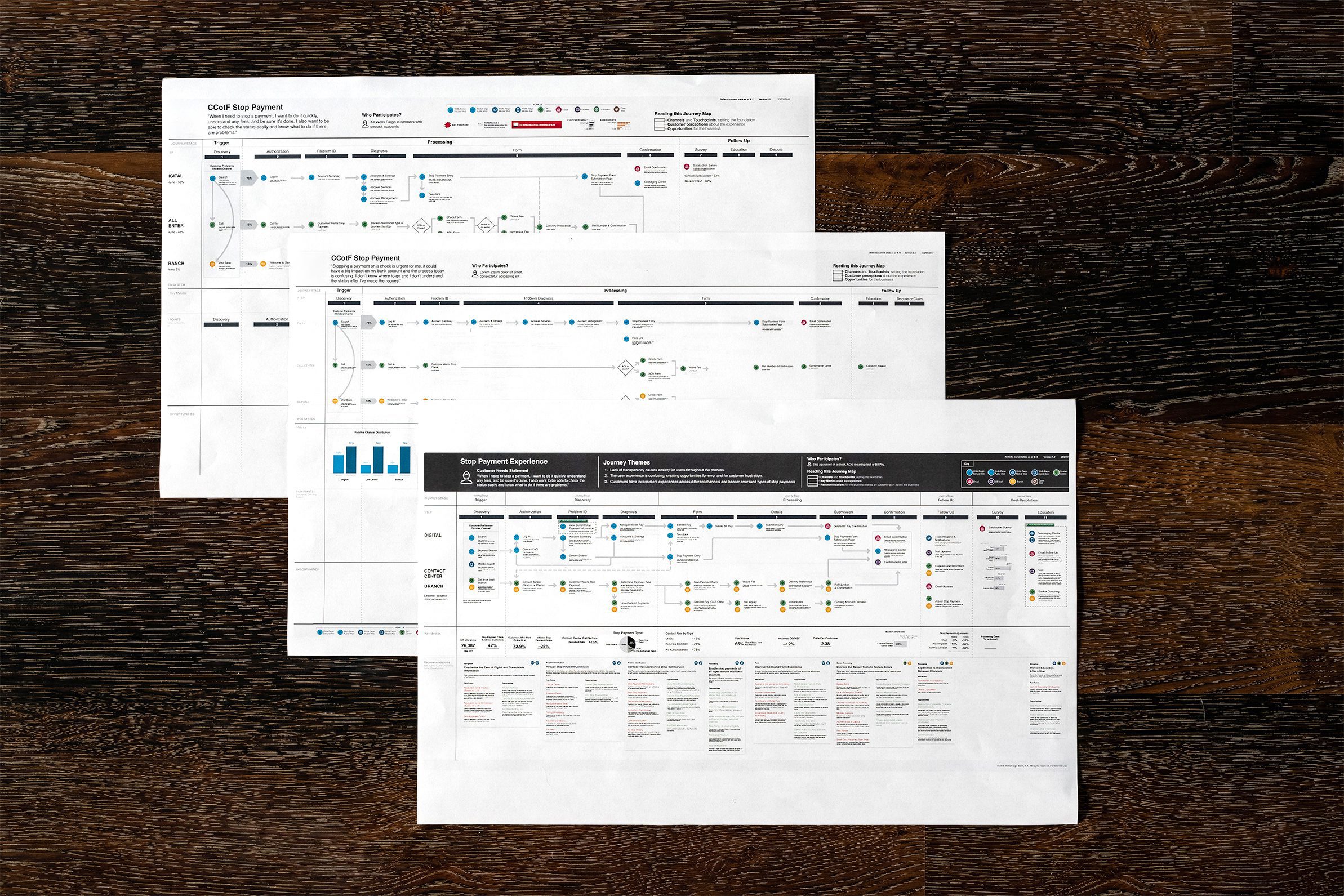

As the bank's journey mapping agency of record, we partnered with multiple business units to create, implement, and maintain 22 journey maps.

The maps themselves are designed to clarify the ideal flow, making processes more consistent, and delivering better customer experiences. They also providing a canvas for ideation, framing new opportunities for ongoing improvement and innovation.

The maps themselves are designed to clarify the ideal flow, making processes more consistent, and delivering better customer experiences. They also providing a canvas for ideation, framing new opportunities for ongoing improvement and innovation.

A collaborative way to understand how people experience the service through every touchpoint and channel

The Value

With our journey mapping expertise, the bank has broken down silos and aligned disparate teams around the customer experience.

Together, we have identified key areas of opportunity and innovation that have increased efficiency, consistency, and customer satisfaction.

Shaped a more consistent customer experience:

We standardized processes across channels to make the customer experience more consistent.

Eliminated inefficiencies:

By identifying and eliminating inefficiencies, we accelerated customer service processes.

Encouraging ongoing improvement:

Supporting maintenance and innovation to ensure ongoing improvement.

Together, we have identified key areas of opportunity and innovation that have increased efficiency, consistency, and customer satisfaction.

Shaped a more consistent customer experience:

We standardized processes across channels to make the customer experience more consistent.

Eliminated inefficiencies:

By identifying and eliminating inefficiencies, we accelerated customer service processes.

Encouraging ongoing improvement:

Supporting maintenance and innovation to ensure ongoing improvement.