The challenge

Ellie Mae, a real estate fintech firm, is a leading provider of innovative, on-demand software for the residential mortgage industry.

The company wanted to make it easier for borrowers and lenders to complete loan applications, while leveraging technology to maintain their competitive advantage. By automating the loan origination process, Ellie Mae hoped to save time and improve the experience for their primary customer (lenders) and lenders’ primary customers (borrowers).

The company wanted to make it easier for borrowers and lenders to complete loan applications, while leveraging technology to maintain their competitive advantage. By automating the loan origination process, Ellie Mae hoped to save time and improve the experience for their primary customer (lenders) and lenders’ primary customers (borrowers).

Offerings

Product Strategy

Experience Design

Software Architecture and Design

Software Development

A self-service portal that saves everyone time

The solution

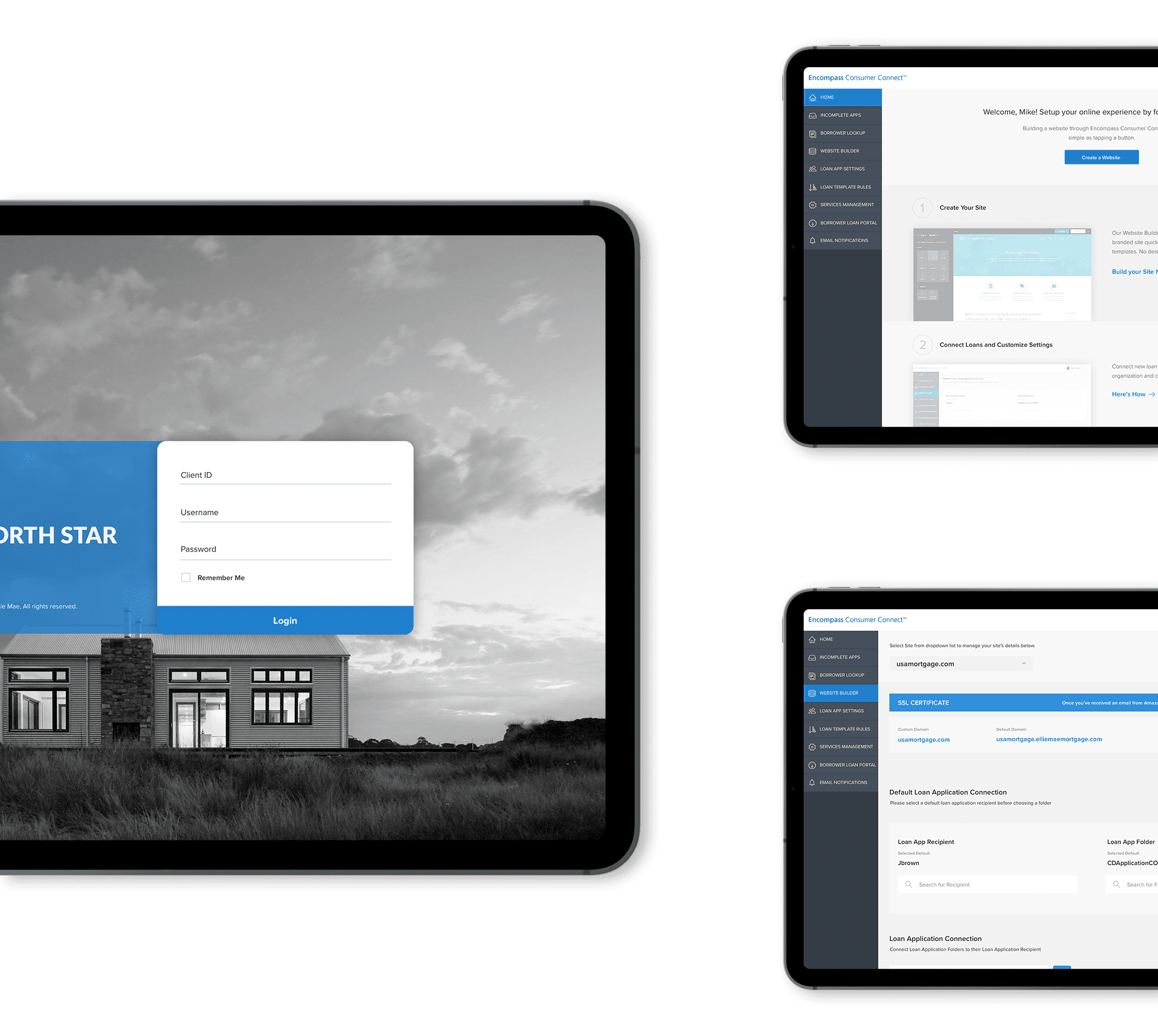

Method (formerly Skookum) partnered with Ellie Mae to create an all-in-one mortgage management solution that improves compliance, loan quality, and efficiency.

We worked together to define the ideal experience for both lenders and borrowers, create UX designs, develop the architecture strategy to enable a cross-platform experience, and prioritize development features. Since Method has an in-depth knowledge of the platform’s APIs, we also extended its value through seamless integrations that make it easier to build and deploy new custom applications rapidly.

We worked together to define the ideal experience for both lenders and borrowers, create UX designs, develop the architecture strategy to enable a cross-platform experience, and prioritize development features. Since Method has an in-depth knowledge of the platform’s APIs, we also extended its value through seamless integrations that make it easier to build and deploy new custom applications rapidly.

A better experience for both borrowers and lenders

The value

Borrowers can now complete their mortgage application online 24/7. Then, the solution automates the origination process to save lenders time. By helping both parties, Ellie Mae can provide a superior solution and maintain a competitive edge.

Enabled 24/7 self-service for borrowers: Now borrowers can complete their own applications anytime.

Automated the loan origination process: Making it easier for lenders by automating the origination process.

Saving time for both parties: Accelerated the mortgage application and closing processes.

Enabled 24/7 self-service for borrowers: Now borrowers can complete their own applications anytime.

Automated the loan origination process: Making it easier for lenders by automating the origination process.

Saving time for both parties: Accelerated the mortgage application and closing processes.